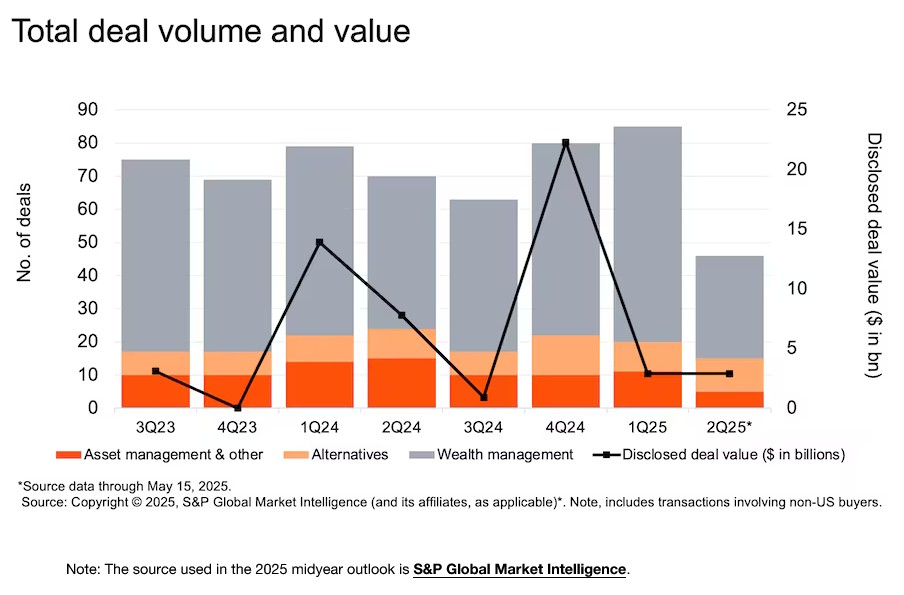

The pace of dealmaking in the US wealth and asset management sector slackened in the first half of this year as uncertainties caused by US tariff policy, domestic economic and foreign policy encouraged firms to sit on their hands, figures show.

Even so, fee pressure, the drive to acquire economies of scale, and the desire of aging founders to exit and transition management to the next generation continues to drive deals in the wealth management space, according to the PricewaterhouseCoopers US Deals Midyear Outlook 2025: Asset and Wealth Management report.

So far in 2025, deals rose in the first quarter but fell sharply in Q2 . Hightower has resumed making acquisitions with a new CEO in place; Mercer Advisors remains a significant acquirer. A continued trend is the involvement of private equity in deals.

Earlier this year, large deals have included Pitcairn's acquisiton of Brightside Partners; AITi Tiedemann Global's deal for a German multi-family office, and LPL Financial's agreement to buy Commonwealth Financial Network.

The PwC report said firms remain “guardedly optimistic about the opportunities presented by recent market disruption.”

“Deals continue to be driven by businesses’ efforts to strategically reposition themselves in order to offer new products, access new markets and enhance their ability to attract new assets under management,” the report said.

“Businesses continue to combine and partner to diversify their product offerings, leveraging existing client relationships to attract new investor capital with a broader array of investment options,” it continued.

The report gave the asset management example of BlackRock, which acquired HPS Investment Partners, a private credit manager, in December 2024 in order to boost its private market offerings. BlackRock also bought Global Infrastructure Partners earlier in 2024.

Alternative future

The report said the expansion of alternative investment products into the retail channel is “reshaping the industry.”

“We expect private markets to become more accessible as alternative asset managers launch retail-focused vehicles, primarily in infrastructure and credit , with some exposure to PE. These products offer high net worth individuals access to return profiles historically limited to institutional investors through closed-end funds. In many cases, they may co-invest alongside institutional vehicles managed by the same firm, broadening access to high-quality alternative strategies,” it said.

“We’re seeing a growing wave of strategic discussions between alternative and traditional asset managers, as well as banks, aimed at co-developing retail offerings and expanding retail access to private markets. This trend may signal increased partnerships and potential M&A activity as alternative managers race to scale their retail capabilities,” it continued.

Elsewhere, the report said that “GP staking platforms” are increasingly facing the challenge of how to exit long-dated, illiquid positions as the market matures. stake investment is a direct ownership share in a private market sponsor, enabling access to the cash flow of the GP, which is composed of management fees, carried interests and balance sheet income from existing and future products.)

At issue is that many early “staking” investments were made by people expecting to have indefinite ownership or monetization of the stake, based on growth by the GP, or succession. “Now, with some positions reaching or surpassing a 10-year hold, platforms are exploring secondary sales, continuation vehicles and other structured exit solutions,” the report said.